Archives

Business, Feature, Freight News, Sea

Drewry Ports Throughput Index Improves

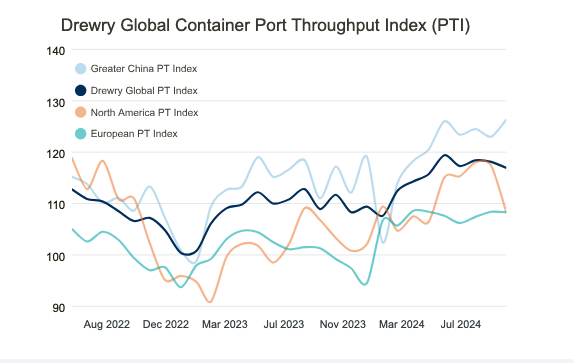

[ December 3, 2024 // Gary G Burrows ]Drewry’s September Global Container Port Throughput Index improved 4.7 percent from the year-earlier quarter, though down 0.3 percent from August.

The rolling 12-month average growth rate for global port handling remained at 5.5 percent, while global year-to-date growth to September was 6.5 percent, with all regions except the Middle East and South Asia recording positive volume growth. Latin America recorded the highest growth, up 11.8 percent year-to-date, with North America close behind at 11.6 percent.

The port throughput indexes are a series of calendar adjusted volume growth/decline indices based on monthly throughput data for a sample of more than 340 ports worldwide, representing over 80 percent of global volumes.

Drewry’s Nowcast model, which uses vessel capacity and terminal duration data (derived from our proprietary AIS model) to make short-term predictions of port throughput, anticipates the Global Port Throughput Index to have softened further 1.1 percent month-on-month in October to 116.9 points.

The Greater China Container Port Throughput Index fell 1.2 percent MoM to 123.0 points in September but was up 3.9 percent YoY. MoM volume growth at the largest ports turned negative in September in the run-up to China’s Golden Week holidays at the beginning of October. Volumes at most leading ports were well ahead of 2023 throughput levels, with Xiamen and Hong Kong the notable exceptions.

The European Container Port Throughput Index rose 0.9 percent in September to 108.4 points, up 6.8 percent YoY. Additionally, the rolling 12-month average growth rate improved again to 4.1 percent. The gap in growth between the sub-regions has narrowed in recent months – the rolling 12-month average growth rate in September was 3.4 percent in North Europe, compared to 4.8 percent in South Europe.

The Middle East and South Asia Container Port Throughput Index increased 0.9 percent in September, up 2.1 percent YoY, but the 12-month rolling average growth rate fell further into negative territory at -1.0 percent. The gap in volume growth between South Asia and the Middle East continued to widen – the 12-month rolling average growth rate for South Asia rose to 8.6 percent in August, while that of the Middle East plunged to -10.7 percent due to the ongoing security situation in the Red Sea. Volumes at major Indian ports in 3Q24 grew by double digits compared to 3Q23, with traffic at Jawaharlal Nehru Port up 16 percent YoY for the quarter.

Tags: Drewry